The PMF Framework: A Step-by-Step Canvas for Product-Market Fit

TL;DR: The PMF Framework in 60 Seconds

- What: A PMF framework is a systematic approach to finding and measuring product-market fit instead of relying on gut feeling.

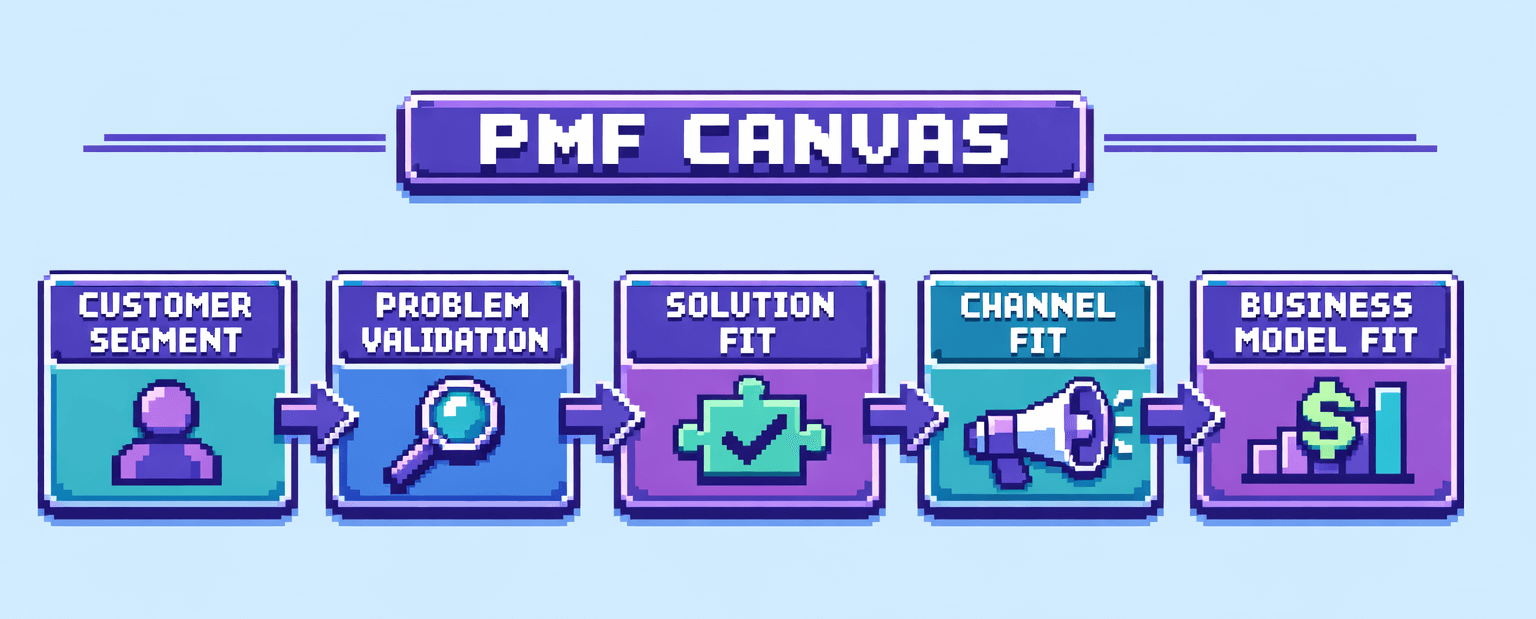

- The Canvas: Five components—Customer Segment, Problem Validation, Solution Fit, Channel Fit, and Business Model Fit.

- Key Metric: Sean Ellis Test—40% of users saying they'd be "very disappointed" without your product indicates PMF.

- Business Metric: LTV/CAC ratio of 3:1 or higher signals sustainable unit economics.

- Critical Truth: Most founders iterate through 3-5 canvas versions before finding fit. Patience and rigor beat speed.

A PMF framework transforms the abstract goal of "finding product-market fit" into a concrete, measurable process. Instead of hoping you'll "know it when you see it," you work through validated components that build toward fit. This guide presents the PMF Canvas—a five-component framework—along with the metrics that matter and the mistakes that derail most founders.

What Is a Product-Market Fit Framework?

A product-market fit framework is a structured methodology for discovering whether your product satisfies strong market demand. It replaces intuition with systematic validation.

Why does this matter? Because gut feeling is unreliable. Founders consistently overestimate their product's fit. Early adopters say they love it. Friends and family are enthusiastic. Initial traction feels promising. Then growth stalls, churn climbs, and reality hits: you never had true fit.

A framework forces discipline. It breaks the ambiguous goal of "achieving PMF" into specific, testable components. Each component has clear validation criteria. You either meet them or you don't. No wishful thinking allowed.

"There is one metric that really helps drive your entire business." – Ben Yoskovitz, Author of Lean Analytics

Ben's insight cuts to the core of why frameworks matter. Without structure, founders chase dozens of metrics—downloads, page views, feature usage, social mentions—without knowing which actually indicate fit. A PMF framework identifies the handful of signals that matter and ignores the rest.

The most widely referenced PMF benchmark comes from Sean Ellis, who ran growth at Dropbox and LogMeIn. His test is simple: ask users "How would you feel if you could no longer use this product?" If 40% or more say "very disappointed," you have PMF. Below 40%, you don't.

This benchmark emerged from Ellis analyzing hundreds of startups. Those above 40% consistently grew faster and more sustainably. Those below struggled regardless of marketing spend or team quality.

The PMF Canvas: A Five-Component Framework

The PMF Canvas breaks product-market fit into five interdependent components. Each builds on the previous. Skip or rush any component, and your foundation cracks under scaling pressure.

Component 1: Customer Segment

Who specifically has the problem you're solving? "Everyone" is not a segment. Neither is "small businesses" or "millennials."

A valid customer segment is:

- Specific: Job title, company size, industry, geography, situation

- Reachable: You can identify and access these people affordably

- Viable: Enough revenue potential to build a real business

- Homogeneous: Similar enough that one product serves them well

Validation Checklist:

- Can you name 10 specific people who fit your segment?

- Do they share the same problem with similar intensity?

- Can you reach them through a channel you can afford?

- Is the segment large enough for your growth goals?

Facebook started with Harvard students. Amazon started with book readers. Uber started with affluent San Francisco professionals. Tight initial focus enabled deep fit that later expanded.

Component 2: Problem Validation

Does this segment have a problem painful enough to pay for a solution? Not "would be nice to solve"—genuinely painful.

Signs of a validated problem:

- Active searching: People are already looking for solutions

- Money spent: They're paying for imperfect alternatives

- Workarounds built: They've cobbled together manual processes

- Quantifiable cost: The problem costs time, money, or opportunity

Validation Checklist:

- Have you interviewed 20+ people in your segment about this problem?

- Can they articulate the problem without prompting?

- Have they tried to solve it before? What did they try?

- Can they quantify the cost (hours lost, revenue missed, frustration)?

The key question isn't "Do they have this problem?" It's "Is this problem in their top three priorities?" People have many problems. They only pay to solve the urgent ones.

Component 3: Solution Fit

Does your specific solution solve the validated problem effectively? A validated problem doesn't guarantee your particular approach works.

"Vanity metrics make us feel good, but they don't move the needle." – Ben Yoskovitz, Author of Lean Analytics

Solution fit requires evidence beyond enthusiasm. Users saying they "love the concept" doesn't count. Track behavioral signals:

- Activation: Do users complete core actions in their first session?

- Return usage: Do they come back within 7 days? 30 days?

- Task completion: Can they accomplish their goal?

- Time to value: How quickly do they experience the benefit?

Validation Checklist:

- What percentage of signups complete the core action?

- Do users return after the first session?

- What's the 30-day retention rate?

- What do churned users say about why they left?

If activation is low, your onboarding fails to deliver the promise. If return usage is low, the value isn't compelling enough to form a habit. Both indicate solution fit problems.

Component 4: Channel Fit

Can you reach your customer segment through scalable, affordable channels? A great product for the right segment solving a real problem still fails if you can't reach customers economically.

Channel fit means:

- Discovery: Target customers can find you

- Economics: Customer acquisition cost (CAC) works with your price point

- Scalability: The channel can grow with your ambitions

- Control: You're not entirely dependent on a third party

Validation Checklist:

- What's your current CAC by channel?

- Is CAC below 1/3 of customer lifetime value?

- What percentage of signups come from organic versus paid?

- Which channel has the best conversion rate?

Many startups achieve solution fit but struggle with channel fit. The product works for users who find it, but finding users is prohibitively expensive. This is still a PMF problem—just at a different layer.

Component 5: Business Model Fit

Do the unit economics work? Can you deliver value profitably at scale?

Business model fit requires:

- Willingness to pay: Customers pay at a price that works

- LTV/CAC ratio: At least 3:1, ideally 5:1 or higher

- Payback period: Recover CAC within 12 months

- Gross margin: Enough profit per customer to cover operations

Validation Checklist:

- What's your current LTV/CAC ratio?

- How long to recover acquisition cost?

- What percentage of customers pay full price (versus discounted)?

- What's your gross margin per customer?

Startups often achieve the first four components but fail here. Users love the product and acquisition works, but the price point doesn't support the cost structure. This forces either price increases (risking churn) or cost cuts (risking quality).

How to Use the PMF Framework

The canvas provides the what. Here's the how—a step-by-step process for working through each component.

Step 1: Define Your Hypothesis

Start with explicit assumptions about each canvas component. Write them down:

- Segment hypothesis: "B2B SaaS product managers at companies with 50-500 employees"

- Problem hypothesis: "They waste 10+ hours weekly on manual roadmap updates"

- Solution hypothesis: "Automated sync from project tools reduces this to 1 hour"

- Channel hypothesis: "LinkedIn content and Product Hunt launch"

- Model hypothesis: "$50/month/user, targeting 3+ seats per company"

These hypotheses will be wrong. That's expected. The point is making assumptions explicit so you can test them systematically.

Step 2: Validate Customer Segment

Before building anything, confirm your segment exists and is reachable.

Run this validation:

- Create a list of 50 specific people who fit your segment hypothesis

- Reach out to 25 for customer discovery interviews

- Complete at least 15 interviews (20+ is better)

- Document patterns: Are they similar enough? Do they share the problem?

If you can't find 50 people or can't get 15 interviews, your segment is either too narrow or you lack channel access. Adjust the hypothesis.

Step 3: Test Problem-Solution Fit

With segment validated, test whether your solution approach resonates.

"An MVP is the smallest thing to learn the next most important thing." – Josh Seiden, Author of Lean UX

Your MVP for this stage isn't a full product. It might be:

- A landing page describing the solution (measure signups)

- A manual version of the service (concierge MVP)

- A demo video (Dropbox validated with just this)

- A clickable prototype (test workflows without building)

The goal: learn whether this specific solution generates real interest. Email signups, waitlist joins, pre-orders—these are early demand signals.

Step 4: Measure with Data

Once you have users, track the metrics that indicate fit.

"I don't sleep well if I don't base my strategy and bets on data." – Konrad Heimpel, VP Product at GetSafe

Weekly metrics to track:

- Activation rate: Users who complete core action / Total signups

- Retention (week 1, 4, 12): Users still active / Users who signed up in that cohort

- PMF survey score: Percentage saying "very disappointed"

- NPS: Promoters minus detractors

Monthly metrics to track:

- LTV: Average revenue per user × average lifespan

- CAC: Total acquisition spend / New customers

- Payback period: CAC / Monthly revenue per customer

- Organic percentage: Non-paid signups / Total signups

Plot these over time. PMF shows up as improving trends across multiple metrics simultaneously—not just one metric spiking.

Step 5: Iterate or Scale

Based on data, make a clear decision:

Iterate if:

- PMF survey below 40%

- Week-4 retention below 20%

- LTV/CAC below 3:1

- High churn from specific causes you can address

Scale if:

- PMF survey at 40%+ consistently

- Retention curves flatten (not decline to zero)

- LTV/CAC at 3:1+ with improving trend

- Organic growth contributing meaningfully

Most startups iterate through 3-5 complete cycles before finding fit. Each cycle should be faster than the last as you learn what works.

PMF Metrics That Matter

Not all metrics indicate PMF. Here are the ones that do—and their benchmarks.

The Sean Ellis Test

Question: "How would you feel if you could no longer use [product]?"

- Very disappointed

- Somewhat disappointed

- Not disappointed

Benchmark: 40%+ "very disappointed" = PMF

Run this survey to users who have experienced your core value—not everyone who signed up. Filter for users with at least 2 weeks of usage and 3+ sessions.

Retention Curves

Plot the percentage of users still active over time (7 days, 30 days, 60 days, 90 days).

Benchmark: Curves that flatten indicate PMF. Curves that decline to zero indicate no fit.

Good retention at 90 days:

- Consumer apps: 25%+

- B2B SaaS: 40%+

- Marketplaces: 30%+

LTV/CAC Ratio

Customer Lifetime Value divided by Customer Acquisition Cost.

Benchmark:

- Below 1:1 = Losing money on every customer

- 1:1 to 3:1 = Unit economics marginal

- 3:1+ = Sustainable growth possible

- 5:1+ = Strong unit economics

Calculate LTV as: (Average Revenue Per User) × (Average Customer Lifespan in months)

Calculate CAC as: (Total Sales + Marketing Spend) / (New Customers Acquired)

Revenue Signals

Revenue itself indicates PMF when:

- Customers pay without heavy discounting

- Expansion revenue exists (upgrades, additional seats)

- Net Revenue Retention exceeds 100% (B2B SaaS)

- Payback period under 12 months

Revenue that requires constant discounting or aggressive sales tactics signals weak fit—customers need convincing rather than pulling the product from you.

Common PMF Framework Mistakes

Knowing the framework isn't enough. You must also avoid the traps that derail most founders.

Mistake 1: False Positives from Early Adopters

Early adopters will try anything new. Their enthusiasm doesn't indicate mainstream fit.

Early adopters:

- Tolerate bugs and friction

- Get excited about novelty

- Have different needs than mainstream users

- Represent a tiny fraction of your market

Test with mainstream users in your segment—not just the enthusiasts who found you first. If PMF survey scores drop when you move beyond early adopters, you have early-adopter fit, not product-market fit.

Mistake 2: Confusing Growth with Fit

Growth can mask fundamental fit problems. Paid acquisition, viral marketing, and press coverage can all drive signups without indicating whether users stick around.

Ask yourself:

- What percentage of growth is organic?

- What happens to cohort retention over time?

- Do users refer others unprompted?

- Would growth continue if you stopped spending?

If growth requires constant spending, you're buying customers, not earning them. That's a marketing achievement, not PMF.

Mistake 3: Ignoring Retention Data

New signups feel good. Retention tells the truth.

A startup adding 1,000 users per month but losing 900 has a 10% monthly retention rate. That's not growth—it's a leaky bucket. All the acquisition effort goes toward replacing churned users rather than compounding growth.

Fix retention before scaling acquisition. Every percentage point of retention improvement compounds over time.

Mistake 4: Skipping Canvas Components

Founders often jump from customer segment directly to solution, skipping problem validation. Or they validate the problem but never confirm channel fit.

Each canvas component serves a purpose:

- Skip segment validation → build for the wrong people

- Skip problem validation → build something nobody needs

- Skip solution fit → build something that doesn't work

- Skip channel fit → build something nobody finds

- Skip model fit → build something that can't sustain itself

The framework is sequential for a reason. Earlier components inform later ones.

Mistake 5: Measuring Once Instead of Continuously

PMF isn't a one-time achievement. Markets shift, competitors emerge, and customer needs evolve.

Run the Sean Ellis survey monthly. Track retention cohorts weekly. Monitor LTV/CAC quarterly. PMF can erode gradually—continuous measurement catches the decline before it becomes critical.

After PMF: What's Next?

Finding PMF changes everything. The questions shift from "Does this work?" to "How fast can we scale?"

But scaling prematurely—before PMF is genuinely achieved—destroys companies. The Startup Genome project found premature scaling is the number one cause of startup failure.

Confirm Before You Scale

Before investing heavily in growth:

- Achieve 40%+ on Sean Ellis survey for 3+ consecutive months

- See retention curves that flatten, not decline to zero

- Confirm LTV/CAC at 3:1 or improving

- Have organic growth contributing 30%+ of signups

One good month isn't PMF. Sustained performance across multiple metrics is.

Document What Works

Before scaling, capture exactly what's working:

- Which customer segment has the highest retention?

- What messaging resonates in acquisition?

- Which features do power users love?

- What's the typical journey from signup to activation?

This documentation becomes the foundation for your product strategy as you grow. Scaling means replicating what works—which requires knowing what works.

Expand Thoughtfully

Post-PMF expansion options include:

- Adjacent segments: Similar customers with the same problem

- New use cases: Same customers with related problems

- Geographic expansion: Same segment in new markets

- Upmarket/downmarket: Larger or smaller customers

Each expansion requires re-validating the canvas. PMF in one segment doesn't guarantee PMF in another. Treat expansions as mini-PMF searches with the same rigor as your initial product.

For a comprehensive understanding of product-market fit—what it is, how to measure it, and what it feels like when you achieve it—see the complete product-market fit guide.

Frequently Asked Questions

What's the difference between a PMF framework and just measuring PMF?

Measuring PMF tells you whether you have fit. A framework tells you how to find it. The Sean Ellis survey gives you a score—but if you score below 40%, it doesn't tell you what to fix. The PMF Canvas breaks fit into five components so you can identify exactly where the problem lies and focus your iteration.

How long should each canvas component take to validate?

There's no universal timeline, but rough guidance: Customer Segment validation takes 2-4 weeks of interviews. Problem Validation overlaps with segment work. Solution Fit takes 4-8 weeks of MVP testing. Channel and Model Fit require 2-3 months of real customer data. Most startups need 6-12 months to work through the full canvas once—and most cycle through multiple times.

Can I work on multiple canvas components simultaneously?

Partially. Customer Segment and Problem Validation naturally overlap. But don't build (Solution Fit) before validating the problem, and don't optimize channels or pricing before confirming your solution works. The sequential structure exists because each component depends on the previous one being validated.

What if my PMF metrics conflict?

This happens often. High retention but low growth suggests channel fit problems. High growth but low retention suggests solution fit problems. High PMF survey scores but poor unit economics suggests business model problems. Conflicting metrics help you diagnose which canvas component needs work.

Start Working Your Canvas

A PMF framework replaces hope with process. Instead of wondering whether you'll find fit, you work through validated components methodically.

The PMF Canvas gives you five components to validate:

- Customer Segment: Who specifically has this problem?

- Problem Validation: Is it painful enough to pay for?

- Solution Fit: Does your approach actually work?

- Channel Fit: Can you reach customers economically?

- Business Model Fit: Do the unit economics work?

Work through them sequentially. Validate each before moving to the next. Track the metrics that matter—Sean Ellis survey, retention curves, LTV/CAC. Iterate until the numbers indicate fit, then scale with confidence.

Most founders cycle through the canvas 3-5 times before finding fit. The difference between success and failure isn't avoiding iteration—it's iterating systematically with clear validation criteria.

Looking to apply frameworks like this to your product discovery process? The same rigor that finds PMF also identifies which problems to solve and which solutions to build.