Product-Market Fit: What It Is and How to Measure It

TL;DR: Product-Market Fit in 60 Seconds

- Definition: Product-market fit (PMF) is when your product satisfies strong market demand. Customers need it, buy it, and recommend it to others.

- Key Indicator: 40% or more of surveyed users would be "very disappointed" if they could no longer use your product.

- How to Measure: Use the PMF Survey, track retention cohorts, and monitor CLV:CAC ratio (target 3:1 or higher).

- Why It Matters: 90% of startup failures correlate with not achieving PMF. Scaling before fit destroys companies.

- Timeline: Most successful products take 18 months to 4 years to find PMF.

Product-market fit is the moment when your product stops being a solution in search of a problem and becomes the solution to a problem people are desperate to solve. It's the difference between pushing your product uphill and having customers pull it out of your hands. Below, you'll learn exactly what PMF is, how to find it, how to measure it, and what it feels like when you've achieved it. This guide includes frameworks specific to your business model.

This guide synthesizes insights from founders at ProductPlan, GetSafe, GitHub, and Lean Analytics to give you a practical, actionable framework for finding and measuring product-market fit.

What is Product-Market Fit?

Product-market fit (often abbreviated as PMF) occurs when a product meets strong market demand. The term was popularized by Marc Andreessen in his influential 2007 essay, where he defined it as "being in a good market with a product that can satisfy that market."

But that definition, while accurate, doesn't capture what PMF actually feels like or how to know when you have it. It's abstract when you need something concrete.

A more practical definition: Product-market fit is when customers are not just using your product, but actively pulling it from you. They're telling their colleagues about it. They're asking for features. They're upset when it's down. They're paying, often before you've even figured out pricing.

Andy Rachleff, who coined the term before Andreessen popularized it, described PMF as the point where "the market pulls product out of the startup." You're no longer pushing; you're being pulled.

"An email address is a valuable commodity. That in itself is great validation." – Jim Semick, Founder of ProductPlan

Jim's insight cuts to the core of early PMF signals. When potential customers are willing to give you their contact information before you've even built anything, that's validation. It means the problem you're solving matters enough that they want to hear from you. They're investing their attention, which is the scarcest resource in the digital age.

This is why landing page tests work: if people won't give you an email address, they certainly won't give you their time or money. The email is the minimum viable signal of demand.

The Origin of Product-Market Fit

Understanding where the concept came from helps you apply it correctly.

Don Valentine, founder of Sequoia Capital, was among the first to articulate the importance of market over everything else. His philosophy: "Give me a giant market. Always." Valentine backed Cisco, Apple, and Oracle not because of their products initially, but because of the markets they addressed.

Andy Rachleff, who founded Benchmark Capital and later Wealthfront, synthesized Valentine's thinking with his own experience to define product-market fit. His key insight: "When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens."

Marc Andreessen then popularized the concept through his blog, making it accessible to the broader startup ecosystem. His vivid description, "you can always feel product-market fit when it's happening," gave founders a gut-check alongside the analytical frameworks.

What Product-Market Fit is NOT

Before diving deeper, let's clear up common misconceptions that lead founders astray:

PMF is not a one-time event. Markets shift, competitors emerge, customer needs evolve, and technology changes. BlackBerry had PMF until the iPhone redefined what a smartphone should be. Blockbuster had PMF until Netflix redefined content distribution. PMF requires ongoing maintenance and can be lost.

PMF is not the same as growth. You can have early traction without PMF. Viral marketing, press coverage, or heavy spending can create temporary growth that masks fundamental fit problems. This is why the most dangerous phase for startups is often right after launch. Vanity metrics can fool you into thinking you've found fit when you haven't.

PMF is not just about the product. It's about the intersection of product, market, and timing. A great product in the wrong market at the wrong time fails. Webvan had a great product (online grocery delivery) but the market and infrastructure weren't ready in 1999. Instacart succeeded with a similar product 15 years later because the market had matured.

PMF doesn't mean everyone loves your product. It means a specific segment of customers finds it indispensable. Facebook initially had PMF only with Harvard students. Slack initially had PMF only with tech teams. Narrow, deep fit beats broad, shallow appeal.

PMF isn't about features. Adding more features doesn't create fit. Many founders make this mistake. When users aren't engaging, they build more. But features don't solve a lack of product-market fit; they often make it worse by adding complexity.

The PMF Spectrum

Product-market fit isn't binary. It exists on a spectrum. Understanding where you are on this spectrum helps you decide what to do next:

| Stage | Description | Signals | What to Do |

|---|---|---|---|

| No Fit | Product doesn't solve a real problem | High churn, no referrals, flat growth, users need heavy convincing | Pivot or dramatically iterate on value proposition |

| Weak Fit | Some users find value, but not enough | Inconsistent retention, slow organic growth, mixed feedback | Double down on what resonates, cut what doesn't |

| Strong Fit | Core users are passionate advocates | 40%+ "very disappointed" score, organic referrals, retention curves flatten | Optimize and prepare to scale |

| Market Pull | Demand exceeds capacity | Waiting lists, inbound sales, viral growth, can't keep up | Scale aggressively, hire, raise capital |

Most startups oscillate between No Fit and Weak Fit for months or years before breaking through. The goal is to move methodically up the spectrum, learning at each stage.

Why Product-Market Fit Matters

Product-market fit isn't just a milestone. It's the single most important factor in determining whether a startup succeeds or fails. Everything else is secondary.

The Data is Clear

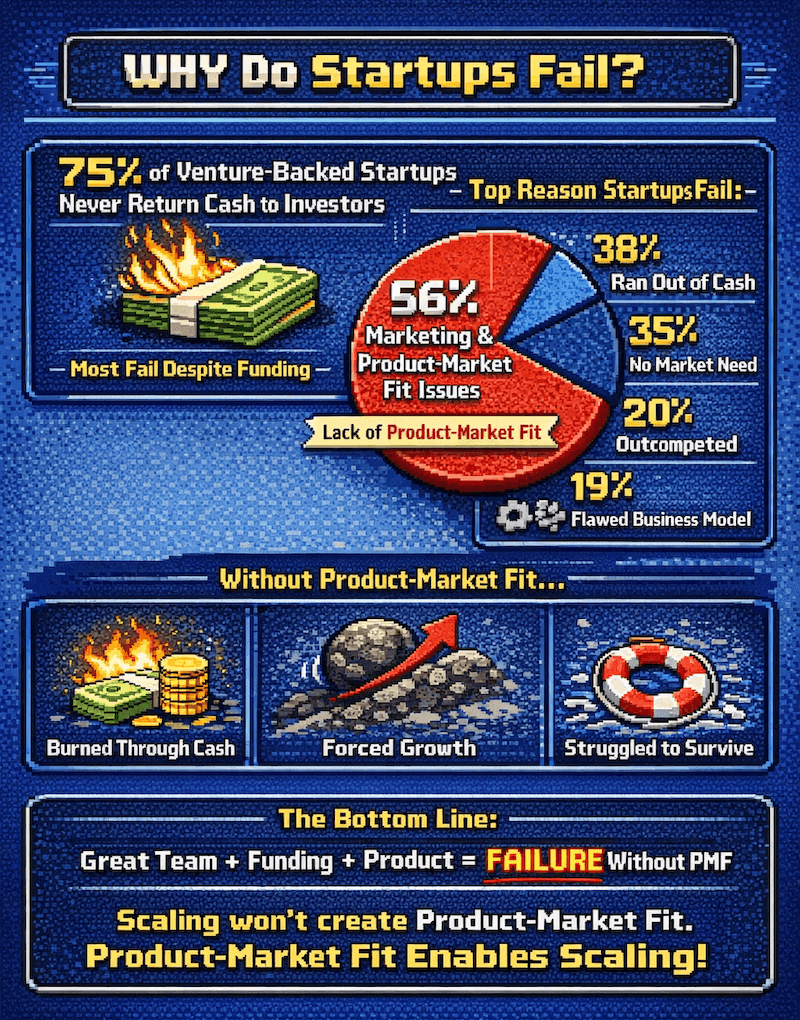

Harvard Business School researcher Shikhar Ghosh found that 75% of venture-backed companies never return cash to investors. Even with significant funding, most startups fail.

Why? Research from Failory, which analyzed 80+ failed startups, points to the answer: 56% of startups fail due to marketing problems, primarily lack of product-market fit.

CB Insights analyzed over 100 startup post-mortems and found similar patterns:

- 38% ran out of cash

- 35% had no market need

- 20% got outcompeted

- 19% flawed business model

These reasons are deeply connected: without product-market fit, you burn cash faster trying to force growth that isn't organic. Money can buy time, but it can't buy fit.

The bottom line: you can have a great team, plenty of funding, and a beautiful product, but without PMF, you'll fail.

"Vanity metrics make us feel good, but they don't move the needle." – Ben Yoskovitz, Author of Lean Analytics

Ben's warning is critical here. Many founders mistake early traction for PMF because they're measuring the wrong things like downloads, page views, social followers, press mentions. These vanity metrics feel good but don't indicate whether you've found fit.

The metrics that matter are retention, engagement, and organic growth. Is someone who signed up last month still using your product? Are they using it more over time? Are they telling others? These are the signals of fit.

The Economics of PMF

Beyond survival, PMF fundamentally changes your unit economics:

Without PMF:

- Customer acquisition is expensive (high CAC)

- Conversion rates are low

- Churn is high

- Lifetime value is low

- Burn rate is unsustainable

- Growth requires constant spending

With PMF:

- Word of mouth reduces CAC

- Conversion rates improve (social proof, referrals)

- Retention improves (product is sticky)

- Lifetime value increases

- Unit economics become positive

- Growth becomes more organic

This is why investors care so much about PMF. It's the difference between a business that can become self-sustaining and one that will always need external capital to survive.

Signs You DON'T Have Product-Market Fit

Recognizing the absence of fit is as important as recognizing its presence. Here are the warning signs:

| Warning Sign | What It Means | What to Do |

|---|---|---|

| Customers need heavy convincing | The problem isn't painful enough or your solution isn't compelling | Revisit problem validation, sharpen value proposition |

| High churn after trial/onboarding | Product doesn't deliver promised value | Fix onboarding, talk to churned users |

| No organic referrals | Not remarkable enough to share | Find what 10x users love, amplify it |

| Constant discounting to close deals | Value proposition isn't compelling at full price | Either raise value or lower price permanently |

| Feature requests all over the map | No clear use case resonating | Segment users, find the common thread |

| Users engage once, then disappear | No habit-forming value | Study the users who do return, understand why |

| Growth only when spending on marketing | No organic pull | Stop spending, focus on product |

| Support tickets are mostly complaints | Product creates frustration, not value | Prioritize core experience over new features |

If you recognize several of these signs, don't despair, but do acknowledge reality. The worst thing you can do is pretend you have fit when you don't and waste resources scaling a leaky bucket.

How to Find Product-Market Fit

Finding PMF isn't about luck. It's a systematic process of discovery, validation, and iteration. For a structured approach with validation checklists for each component, see the PMF framework guide. Here's a proven five-step framework used by successful founders.

Step 1: Define Your Target Customer

You can't achieve PMF with "everyone." The most common mistake founders make is targeting too broadly too early. Start by narrowing your focus to a specific customer segment.

Ask yourself:

- Who has the problem? Be specific: job title, company size, industry, situation, geography.

- How painful is it? Are they actively searching for solutions? Have they tried other things? Are they willing to pay?

- Can you reach them? Do you have access to this audience? Can you acquire customers in this segment affordably?

- Is the segment big enough? Is there enough revenue potential to build a real business?

The tighter your initial focus, the faster you'll find fit. It's easier to expand from a strong niche than to find fit in a broad market. Facebook started with Harvard. Amazon started with books. Uber started with black cars in San Francisco.

Create a detailed persona of your ideal customer. Give them a name. Understand their day, their frustrations, their goals. The more concrete your target, the better your product decisions will be.

Step 2: Understand the Problem (Not the Solution)

Most founders fall in love with their solution before truly understanding the problem. This is backwards. The solution should emerge from deep problem understanding, not the other way around.

"We had interviewed 30 product managers before we started coding. We also had launched a landing page to test the acquisition model before we had a product." – Jim Semick, Founder of ProductPlan

Jim's approach at ProductPlan is the gold standard for finding PMF. Before writing a single line of code, they:

- Conducted 30 customer interviews to understand the problem deeply, including what tools PMs were using, what frustrated them, what they wished existed

- Launched a landing page to test whether people would even sign up, validating demand before building

- Validated the acquisition model before building the product, ensuring they could actually reach customers

This approach dramatically reduces the risk of building something nobody wants. It's cheaper to run interviews and landing page tests than to build a full product.

The key to effective product discovery is asking about problems, not solutions:

- Don't ask: "Would you use this?" (Everyone says yes to be polite.)

- Do ask: "How do you currently solve this problem?" (Shows actual behavior.)

- Do ask: "What's the most frustrating part of that process?" (Reveals pain points.)

- Do ask: "What have you tried before?" (Shows willingness to seek solutions.)

- Do ask: "How much time/money does this problem cost you?" (Quantifies value.)

Document everything. Look for patterns. The insights from 20-30 interviews will shape your entire product direction.

Step 3: Build Your MVP

An MVP (Minimum Viable Product) isn't a crappy version of your product. It's the smallest thing you can build to test your core hypothesis about customer value.

"An MVP is the smallest thing that you can do or make to learn the next most important thing you need to learn." – Josh Seiden, Author of Lean UX

Josh's definition reframes the MVP from a product milestone to a learning tool. The goal isn't to launch something; it's to learn something.

Your MVP should:

- Test your riskiest assumption first. What's the thing that, if wrong, makes everything else irrelevant? Test that first.

- Be small enough to build in weeks, not months. If your MVP takes 6 months, it's not minimum.

- Provide clear signal on whether your hypothesis is correct. You should be able to say "yes, this worked" or "no, this didn't" after launching.

- Be embarrassing. If you're not embarrassed by your MVP, you launched too late.

Sometimes an MVP isn't even a product:

- Landing page: Test demand with a signup page before building anything

- Concierge: Manually deliver the service before automating

- Wizard of Oz: Make it look automated but do it manually behind the scenes

- Video: Dropbox famously validated demand with just a demo video

- Crowdfunding: Validate demand and raise capital simultaneously

The form of your MVP depends on what you're trying to learn. Match the MVP to the hypothesis.

Step 4: Test and Iterate

Launch your MVP to your target segment and watch what happens. This isn't "launch and pray." It's "launch and learn."

Pay attention to:

- Activation: Do people complete onboarding? Where do they drop off?

- Engagement: Do they come back? How often? For how long?

- Retention: Do they stay over time? Plot cohort retention curves.

- Revenue: Will they pay? At what price point?

- Referral: Do they tell others? Unprompted?

Each cycle, gather feedback, identify the biggest barrier to fit, and iterate. This isn't a linear process:expect to loop through multiple times. Each loop should:

- Identify the current biggest problem (through data and user feedback)

- Form a hypothesis about what will fix it

- Build the smallest thing to test that hypothesis

- Launch and measure

- Learn and repeat

A solid product strategy helps you prioritize which problems to solve first and which to defer. You can't fix everything at once.

Step 5: Measure Your Signals

As you iterate, you need quantitative signals to know whether you're getting closer to fit. Gut feeling isn't enough:you need data.

The next section covers measurement in depth, but the key principle is: measure outcomes, not outputs. It doesn't matter how many features you shipped. It matters how user behavior changed.

How to Measure Product-Market Fit

PMF can feel subjective:"you know it when you see it." But there are concrete, quantitative ways to measure it. Good measurement helps you know where you are and whether you're making progress.

The PMF Survey (Sean Ellis Test)

The most widely used PMF measurement is the Sean Ellis survey, popularized by Superhuman's Rahul Vohra. It's simple but powerful.

Ask your users one question:

"How would you feel if you could no longer use [product]?"

- Very disappointed

- Somewhat disappointed

- Not disappointed

The benchmark: 40% or more saying "very disappointed" indicates PMF.

This metric works because it measures dependency, not just satisfaction. Users can be satisfied with a product they could easily live without. PMF requires dependency:users who would genuinely miss your product if it disappeared.

Sean Ellis, who ran growth at Dropbox, LogMeIn, and Uproar, found this 40% threshold by analyzing hundreds of startups. Those above 40% consistently grew faster and more sustainably than those below.

"We used the PMF survey, asking people how happy they are with GetSafe and then putting them into segments. Using the PMF survey is so much better than looking at the NPS because it tells us so much more." – Konrad Heimpel, VP Product at GetSafe

Konrad's insight is crucial: the PMF survey provides more actionable data than NPS because it segments users by their level of dependency. This allows you to:

- Identify your core users: Who are the "very disappointed" people? What do they have in common? What do they use most?

- Understand your value: Ask follow-up questions: "What would you use instead?" and "What is the primary benefit you've received?"

- Find growth levers: How can you convert "somewhat disappointed" users into "very disappointed" users?

Run the PMF survey regularly:monthly or quarterly:to track progress over time.

Quantitative Metrics Dashboard

Beyond the survey, track these metrics continuously:

| Metric | Description | PMF Target | How to Calculate |

|---|---|---|---|

| Retention Rate | % of users still active after 30/60/90 days | 40%+ at 90 days | Users active at day 90 / Users who signed up 90 days ago |

| CLV:CAC Ratio | Customer Lifetime Value / Customer Acquisition Cost | 3:1 minimum, 5:1 strong | (Avg Revenue per User * Avg Lifespan) / Cost to Acquire |

| Net Revenue Retention | Revenue from existing customers including expansion | 100%+ (B2B SaaS) | (Starting Revenue - Churn + Expansion) / Starting Revenue |

| Organic Traffic % | % of signups from non-paid channels | 50%+ of total | Organic signups / Total signups |

| NPS Score | Willingness to recommend (0-10 scale) | 40+ is good, 50+ excellent | % Promoters (9-10) - % Detractors (0-6) |

| Payback Period | Months to recover CAC | <12 months | CAC / Monthly Revenue per Customer |

| Viral Coefficient | New users from existing users | >0.5 (some viral), >1 (truly viral) | Invites sent * Conversion rate / Users |

The PMF Scorecard

Use this comprehensive scorecard to assess your current PMF status. Score each dimension 1-5, then sum your total:

| Dimension | 1 (No Fit) | 3 (Weak Fit) | 5 (Strong Fit) | Your Score |

|---|---|---|---|---|

| PMF Survey | <20% very disappointed | 20-40% | 40%+ | |

| Retention (90-day) | <10% | 10-40% | 40%+ | |

| Organic Growth | 0% organic signups | 10-50% | 50%+ | |

| CLV:CAC | <1:1 (losing money) | 1-3:1 | 3:1+ | |

| Word of Mouth | No unprompted referrals | Some referrals | Primary growth driver | |

| Revenue Efficiency | Burning cash on growth | Break-even unit economics | Profitable per customer | |

| Time to Value | Weeks to activation | Days | Minutes to hours | |

| Support Sentiment | Mostly complaints | Mixed feedback | Mostly feature requests |

Scoring Interpretation:

- 32-40: Strong PMF:scale aggressively

- 24-31: Emerging PMF:optimize, then scale carefully

- 16-23: Weak PMF:iterate before scaling

- 8-15: No PMF:major pivot or iteration needed

Qualitative Signals

Numbers don't tell the whole story. Watch for these qualitative signals that indicate fit:

Positive Signals:

- Inbound demand: Prospects reaching out without marketing:they heard about you

- Customer pull: Users asking "Can I pay for this?" or "When can I get more seats?"

- Emotional language: Words like "love," "can't live without," "game-changer," "life-saver"

- Support tickets shifting: From "how do I use this?" to "how can I do more with this?"

- Competitors noticing: Being mentioned as competition, copied, or acknowledged as a threat

- Talent interest: Great people wanting to join because they use and love the product

- Investment interest: Investors reaching out because of word-of-mouth, not outreach

Negative Signals:

- Having to explain what you do repeatedly, even to target customers

- Users not returning after initial signup

- High support load relative to user base

- Needing to discount heavily to close any deals

- Features requested that have nothing to do with your core value proposition

Product-Market Fit by Business Model

PMF looks different depending on your business model. Using the wrong framework leads to wrong conclusions. Here's how to think about PMF for each major type.

B2B SaaS PMF

For B2B SaaS companies selling to businesses, PMF signals include:

- Enterprise adoption patterns: Deals closing without heavy sales involvement:customers are educated and ready to buy

- Expansion revenue: Existing accounts growing through more seats, higher tiers, or additional products (NRR > 100%)

- CAC payback period: Less than 12 months means unit economics work

- Champion creation: Individual users advocating internally:your product makes them look good

- Procurement pull: Customers pushing to formalize contracts, asking about security compliance, involving legal:they want to institutionalize

- Low logo churn: Customer companies not canceling, even if some individual users leave

Key metric: Net Revenue Retention > 100%:existing customers growing faster than churn. Best-in-class B2B SaaS companies (Slack, Twilio, Datadog) have NRR of 120-150%.

Timeline: B2B SaaS typically takes 2-4 years to find PMF due to longer sales cycles and enterprise requirements.

B2C Consumer PMF

Consumer products have different PMF dynamics:you're selling to individuals, not organizations:

- Viral coefficient: Each user brings in >1 new user organically through shares, invites, or visibility

- DAU/MAU ratio: Daily active users / Monthly active users > 25% indicates the product is part of daily routine

- Session frequency: Users returning multiple times per week (ideally daily)

- Social proof: Organic social media mentions, user-generated content, hashtags

- App store ratings: 4.5+ stars with significant review volume

- Organic downloads/signups: Growth happening without paid acquisition

Key metric: DAU/MAU > 25%:indicates habit formation. Facebook at scale has ~66%. A news app might be 10-15%. A messaging app should be 50%+.

Timeline: Consumer products can find PMF faster (months) but also lose it faster as trends shift.

Marketplace PMF

Marketplaces must achieve fit on both supply and demand sides simultaneously:the chicken-and-egg problem:

- Supply-side fit: Suppliers (sellers, drivers, hosts) earning meaningful income and staying active on the platform

- Demand-side fit: Buyers finding what they need and returning to purchase again

- Liquidity: High probability that a search or listing results in a transaction:supply and demand meeting

- Take rate sustainability: Commission rate that works for both platform and participants

- GMV efficiency: Gross Merchandise Value growing faster than operational costs

- Cross-side network effects: More supply attracting more demand, which attracts more supply

Key metric: Liquidity:the probability that a listing sells or a search succeeds. Airbnb tracks "nights booked per listing" and "listings viewed per booking." Uber tracks "completion rate" and "time to match."

Timeline: Marketplaces often take 3-5 years to achieve PMF because you're solving for fit on multiple sides.

Network Effect Products

Products that get better with more users have unique PMF considerations:

- Engagement density: Frequency of interaction between users:are they actually connecting?

- Network value creation: Users contributing content, connections, or data that makes the product more valuable

- Defensibility threshold: The point where switching costs (social graph, content, reputation) exceed benefits of alternatives

- Power user emergence: A small group driving disproportionate value for the rest

- Clustering: Natural communities forming around the product

Key metric: Engagement density:interactions per user per day/week. LinkedIn tracks connections made, messages sent, content engagement. Discord tracks messages per server, active voice minutes.

Timeline: Network effect products often have long PMF timelines (2-5 years) but create strong moats once established.

What Product-Market Fit Feels Like

Data and frameworks are essential, but PMF also has a distinct feeling. Founders who've experienced it describe it in visceral terms.

Founder Descriptions of PMF

Drew Houston, Dropbox:

"Product-market fit feels like getting pressed into the back of your seat by a fast car or a plane taking off. You're just holding on. Before PMF, you're pushing. After PMF, you're being pulled."

Ryan Graves, Uber:

"Zero marketing budget and we were growing like a weed. Word of mouth was uncontrollable. Every week we'd look at the numbers and just be shocked. We weren't doing anything except trying to keep up."

Marc Randolph, Netflix:

"Everything started working! The numbers all started going in the right direction at the same time. If there was a moment Netflix stopped being a startup and became a real company, it was then."

Tom Preston-Werner, GitHub:

"Users started writing to us asking 'Can we pay for this??' We hadn't even thought about pricing yet. That was the first sign this was going to work."

Sarah Leary, Nextdoor:

"If your users are urgently calling and demanding access to your product, you have clearly built something of real value. People were literally calling our office asking why they couldn't sign up yet."

The Contrast: Before and After PMF

The shift is dramatic:

| Before PMF | After PMF |

|---|---|

| You're pushing the product onto customers | Customers are pulling the product from you |

| Sales require heavy convincing and multiple calls | Customers convince themselves and come inbound |

| Support tickets are "how do I use this?" | Support tickets are "how can I do more?" |

| Growth requires constant effort and spending | Growth happens organically while you sleep |

| Roadmap driven by guesses and founder intuition | Roadmap driven by clear customer demand |

| Churning and scrambling to survive each month | Scaling and hiring to keep up with demand |

| Every meeting is about finding customers | Meetings are about servicing customers faster |

| Wondering if this will ever work | Wondering how fast you can grow |

How Long Does It Take?

Finding PMF typically takes longer than founders expect. Here's data from successful companies:

- Segment (analytics): 1.5 years after nearly shutting down

- Netflix: 18 months of iteration

- Airbnb: 2 years of near-death experiences

- PagerDuty: 2 years before inflection

- Superhuman: 3 years before launch

- Amplitude: 4 years and multiple pivots

- Slack: Built as internal tool, pivoted from gaming company

The Startup Genome study found that founders typically underestimate the time to PMF by 2-3x. If you think it'll take 6 months, budget for 18. If you think 1 year, budget for 3.

This has implications for fundraising, runway, and personal stamina. Finding fit is a marathon, not a sprint.

Common Product-Market Fit Mistakes

Knowing what not to do is as important as knowing what to do. Here are the most common mistakes founders make on the path to PMF.

Mistake 1: Scaling Before Fit

The most expensive mistake is pouring resources into growth before achieving PMF. Signs you're scaling prematurely:

- Hiring salespeople when customers aren't converting organically

- Spending heavily on marketing before retention is proven

- Expanding features before core value is validated

- Entering new markets before dominating one

- Raising large rounds to "grow faster" without fit

The Startup Genome data is clear: premature scaling is the #1 killer. When you scale a leaky bucket, you just lose money faster.

Mistake 2: Confusing Early Traction with PMF

Early adopters will try anything new. Their enthusiasm doesn't prove PMF. True PMF means mainstream users:not just early adopters:find your product essential.

Warning signs of false PMF:

- Growth slows dramatically after initial launch buzz

- Early users came from your network or PR, not organic discovery

- Users love the idea but don't actually use the product

- Retention drops sharply after the first week

Mistake 3: Ignoring Churn Signals

Growth can mask churn problems. If you're acquiring customers as fast as you're losing them, you don't have PMF:you have a leaky bucket.

Focus on retention before acquisition:

- Plot cohort retention curves

- Interview churned users

- Understand why people leave, not just why they join

- Fix the holes before pouring in more water

Mistake 4: Over-Relying on NPS

Net Promoter Score measures willingness to recommend, not dependency. Users can recommend products they could easily live without. The PMF survey ("how disappointed would you be?") is a better measure of fit because it measures dependency.

NPS is still useful:it measures potential virality:but it shouldn't be your primary PMF metric.

Mistake 5: Building for Everyone

Trying to please everyone pleases no one. PMF comes from serving a specific segment exceptionally well, not from serving everyone adequately.

Narrow your focus:

- Pick a specific persona

- Solve their problem completely

- Ignore everyone else (for now)

- Expand only after achieving deep fit

Mistake 6: Ignoring the Market

The market matters more than the product. A great product in a bad market will fail. A mediocre product in a great market can succeed.

Evaluate your market:

- Is it growing?

- Are customers actively seeking solutions?

- Can you reach them affordably?

- Is there enough revenue potential?

After Product-Market Fit: What's Next?

Finding PMF isn't the end:it's the beginning of a new phase. Once you have it, the game changes.

Document What Works

Before scaling, document exactly what's working:

- Who are your best customers? (Demographics, firmographics, behaviors)

- Why do they love you? (Core value proposition, specific features)

- How did they find you? (Acquisition channels that work)

- What's their journey? (From awareness to activation to retention)

This documentation becomes the foundation for your growth machine.

Build the Growth Machine

Now you can invest in scaling acquisition and sales:

- Hire salespeople and customer success

- Increase marketing spend on proven channels

- Build referral and viral mechanics

- Optimize conversion funnels

A comprehensive product launch checklist helps ensure you scale effectively once PMF is achieved. Your go-to-market strategy becomes critical at this stage, translating what works into repeatable market execution.

Expand Thoughtfully

Consider adjacent opportunities:

- Adjacent markets (similar customers, different use cases)

- New features (solving more problems for existing customers)

- Larger segments (moving upmarket or downmarket)

But always verify fit in each new area. PMF in one segment doesn't guarantee PMF in another.

Defend Your Fit

PMF isn't permanent. Monitor continuously:

- Track your PMF metrics regularly

- Stay close to customers

- Watch for market shifts and competitor moves

- Continue iterating even after achieving fit

Your product marketing strategy becomes critical at this stage:translating what works into repeatable, scalable messaging that resonates with your target market.

Frequently Asked Questions

How long does it take to find product-market fit?

Most successful startups take 18 months to 4 years to find PMF. The Startup Genome study found founders typically underestimate this by 2-3x. Plan for a longer journey than you expect and ensure your runway matches.

Can you lose product-market fit after finding it?

Yes. Markets change, competitors emerge, and customer needs evolve. BlackBerry had PMF until the iPhone changed the market. Blockbuster had PMF until Netflix changed distribution. Continuous monitoring and iteration are essential to maintain fit.

What if you can't find product-market fit?

If you've iterated extensively without finding fit (12-18 months of genuine effort), consider pivoting:changing your target market, value proposition, or product entirely. Many successful companies (Slack, YouTube, Instagram, Twitter) pivoted to find PMF.

What's the difference between product-market fit and product-user fit?

Product-user fit means individual users love your product. Product-market fit means enough users in a viable market love it to build a sustainable business. You need both. You can have user fit without market fit (great product, small market) or market fit without user fit (big market, mediocre product experience).

Can you have product-market fit with low revenue?

Initially, yes. PMF is about demand and retention, not revenue. But eventually, you need to prove willingness to pay. Strong engagement without revenue suggests you haven't found the business model, even if product fit exists. This is common with consumer products.

Should you seek PMF before raising funding?

Pre-PMF funding is possible but difficult and expensive (you'll give up more equity). If possible, find at least early signals of fit before raising. Investors increasingly want to see evidence of PMF before Series A. Seed funding can be raised on vision, but Series A typically requires PMF evidence.

How do you know when to give up?

There's no universal answer, but consider giving up or pivoting if: you've been at it for 2+ years without meaningful progress, you've run multiple experiments without finding any signal, the market has fundamentally changed, or you've lost conviction in the problem/solution.

Start Finding Your Fit

Product-market fit is the foundation of every successful product company. Without it, growth is a treadmill:you run faster and faster but never get anywhere. With it, growth becomes inevitable:customers pull you forward.

The path to PMF requires:

- Discipline to focus on a specific customer segment instead of trying to please everyone

- Humility to learn from customers instead of assuming you know what they need

- Patience to iterate through multiple cycles until signals emerge

- Rigor to measure what matters and make decisions based on data, not hope

Use the frameworks in this guide:the 5-step discovery process, the PMF Scorecard, the business model variations:to systematically work toward fit. Track your progress with the PMF survey and retention metrics. Learn from the founders who've been there.

And remember Jim Semick's lesson: before you build, validate. An email address is a valuable commodity. If people won't give you that, they certainly won't give you their time or money either. Start there.

Need help finding product-market fit? Product coaching for startups can accelerate your journey to PMF — or learn about coaching services to get started.