Continuous Discovery: How to Build Research Habits

TL;DR: Continuous Discovery in 30 Seconds

- What it is: A weekly practice of customer conversations, research activities, and insight sharing that keeps product decisions grounded in evidence

- The cadence: 5-7 customer touchpoints per week, distributed across interviews, analytics, usability tests, and support review

- The habit loop: Cue (recurring calendar block), Routine (chosen research method), Reward (actionable insight shared with team)

- Common failures: Research theater (going through motions), researcher bottleneck (one person owns it), insight graveyard (learning but not acting)

- Stage-specific patterns: What works at a 10-person startup fails at a 500-person enterprise. Scale your discovery practice, not just your team.

Continuous discovery is the practice of maintaining weekly customer touchpoints so that product decisions are always informed by recent evidence, not outdated assumptions. It replaces the traditional model of quarterly research projects with a steady rhythm of learning that compounds over time.

The gap between intention and practice is striking. According to Maze's 2023 Product Research Report, 83% of product managers believe research should happen at every stage of development. Yet only 39% maintain weekly touchpoints with customers. That 44-point gap represents millions in wasted engineering effort: teams building features based on assumptions that a single customer conversation could have invalidated.

"Customer development focuses on solutions that solve customer problems AND can be sustainably built." - Cindy Alvarez, GitHub

This article gives you the concrete framework to close that gap. Not theory. Not philosophy. A weekly cadence model, a habit loop you can implement this week, and the stage-specific patterns that determine which approach fits your team right now.

Why Continuous Beats Episodic

Most teams run discovery as a project. They spend two weeks interviewing users before a big initiative, produce a research report, then go silent for months. The problem is that customer behaviors shift faster than quarterly research can track. By the time you act on those findings, the landscape has changed.

| Dimension | Episodic Discovery | Continuous Discovery |

|---|---|---|

| Frequency | Quarterly or project-based | Weekly, embedded in workflow |

| Learning velocity | Slow: big batch, long gaps | Fast: small batch, rapid cycles |

| Insight freshness | Stale within weeks | Always current |

| Team intuition | Atrophies between projects | Strengthens each week |

| Risk detection | Late: problems found after build | Early: problems caught pre-build |

| Cost per insight | High: formal studies, external agencies | Low: lightweight, internal habits |

| Culture impact | Research is "someone else's job" | Research is how the team works |

In my coaching experience, the difference between these two approaches becomes obvious within weeks. I worked with two product teams at similar-stage startups. One ran quarterly research sprints. The other had weekly customer calls built into every PM's calendar. The weekly team caught a critical positioning problem in their third week of interviews. Users loved the product but could not explain what it did to colleagues. The team adjusted their messaging and onboarding in the same sprint. The quarterly team discovered the same problem, but three months later, after they had already invested a full quarter building features that assumed users understood the product's value. That delay cost them four months of effective growth.

"Starting with why is a big one. The more you explain that why, the more you empower teams." - Cindy Alvarez, GitHub

Continuous discovery is not about doing more research. It is about doing the right amount at the right time. When your team is running product discovery as a weekly practice rather than a quarterly event, every product decision draws on evidence that is days old rather than months old.

The compounding effect matters more than any single insight. A team that talks to two customers per week accumulates over 100 conversations per year. Each conversation sharpens intuition, reveals connections between seemingly unrelated problems, and builds the kind of deep customer empathy that no analytics dashboard can provide. After six months of weekly discovery, PMs develop a "sixth sense" for which features will resonate and which will fall flat. That intuition is not magic. It is the accumulated wisdom of hundreds of data points gathered consistently over time.

The Weekly Cadence Model

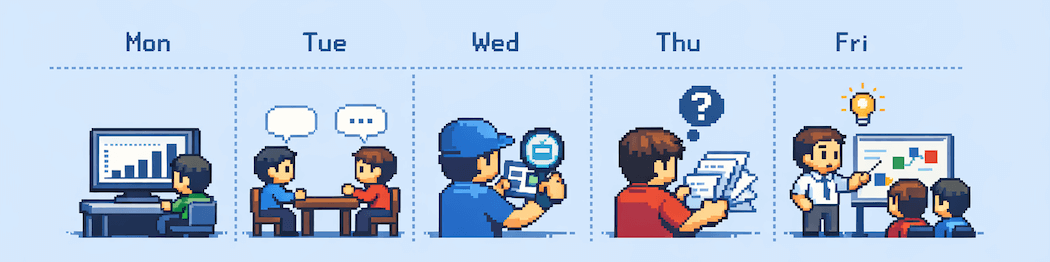

The most common misconception about continuous discovery is that "weekly" means five full user interviews every week. It does not. A weekly cadence means 5-7 customer touchpoints distributed across different research activities. Some take 30 minutes. Some take an hour. The total weekly investment is approximately 5-6 hours per product manager.

| Day | Activity | Duration | What You Learn |

|---|---|---|---|

| Monday | Analytics review | 30 min | Usage patterns, drop-offs, adoption trends |

| Tuesday | 2 customer interviews | 60 min each | Problems, motivations, context |

| Wednesday | Prototype usability test | 45 min | Solution validation, friction points |

| Thursday | Support ticket review | 30 min | Pain points, feature requests, confusion |

| Friday | Synthesis + share insights | 45 min | Patterns across the week, team alignment |

This schedule is a starting point, not a rigid template. The key principle is variety. Interviews alone create a qualitative echo chamber. Analytics alone strip away context. Support tickets alone bias you toward vocal complainers. The weekly mix gives you triangulated evidence: multiple data sources pointing to the same conclusions.

"Five to seven users per segment. That's the magic number for usability testing." - Nikki Anderson, Zalando

That magic number applies beyond formal usability tests. Five to seven touchpoints per week, spread across methods, is enough to maintain a current understanding of your users without consuming your entire schedule. The goal is not exhaustive research. It is enough contact to prevent the assumption drift that happens when teams go weeks without talking to customers. When choosing the right research approach for each day, match the method to what you need to learn that week.

A practical tip for sustaining the cadence: batch your recruitment. Every Monday morning, send five outreach messages to schedule conversations for the current and following week. Use your product's existing communication channels (in-app messages, email newsletters, support follow-ups) to find willing participants. Most teams struggle not because customers refuse to talk, but because nobody asks them. In my experience coaching teams through their first month of weekly discovery, the recruitment problem solves itself once you establish the routine. Previous participants refer colleagues. Support teams flag enthusiastic users. Sales teams share contacts who asked thoughtful questions during demos. The pipeline fills itself after the initial effort.

Building the Habit Loop

Knowing you should talk to customers weekly and actually doing it are different things. The teams that sustain continuous discovery treat it as a habit, not a task. The framework that works is the same one behind any lasting behavioral change: Cue, Routine, Reward.

Cue: The recurring calendar block. Block 90 minutes on Tuesday and Thursday for customer conversations. Make it recurring. Make it non-negotiable. The calendar block is your cue. When teams treat research time as "flexible" or "when I have time," it gets bumped by every meeting invitation that arrives. The teams I coach who sustain weekly discovery for months all share one trait: the calendar blocks are sacred.

Routine: The chosen research method. Rotate your method based on what you need to learn this week. If you are exploring a new problem space, interview. If you shipped a feature last week, do a usability test. If support tickets spiked, review them and follow up with affected users. The rotation prevents method fatigue and ensures you are always using discovery techniques to rotate that match your current questions.

Reward: The actionable insight shared with team. Every Friday, share one insight from the week with your team. Post it in Slack. Mention it in standup. Add it to your shared insight repository. The act of sharing reinforces the habit because it creates social accountability (people expect your weekly insight) and demonstrates value (the team sees research driving decisions).

"The first thing that comes to your mind is usually not the best thing." - Product Bakery Podcast

Integrating this habit loop into existing sprint ceremonies accelerates adoption. Monday's analytics review feeds sprint planning with fresh data. Tuesday's interviews inform story refinement. Wednesday's usability test validates in-progress work. Thursday's support review catches post-release issues. Friday's synthesis closes the loop and sets the agenda for next week's discovery.

The most common objection I hear is "I do not have time for weekly research." But look at the time investment: the full weekly cadence takes 5-6 hours. Compare that to the cost of building the wrong feature for two sprints because nobody talked to a customer. A two-week sprint with three engineers costs roughly 240 engineering hours. If weekly discovery prevents even one misdirected sprint per quarter, the return on those 5-6 weekly hours is massive. The teams that "do not have time" for discovery are the same teams that spend months rebuilding features that missed the mark.

Discovery at Different Company Stages

The pattern I see across the 50+ product teams I have coached is that what works at one company stage fails at another. A startup founder doing three customer calls a week is practicing continuous discovery. Scaling that exact approach to a 500-person company creates chaos. The practice must evolve with the organization.

Startup (5-10 people)

At early stage, the founder or first PM is the entire discovery team. Three to five customer calls per week, scrappy and informal. The founder often knows every customer by name. No formal repository needed because the insights live in one person's head and get discussed at the daily standup.

What works: Speed and directness. Call a customer, learn something, ship a change the same day. The feedback loop is measured in hours, not sprints.

What breaks: When the second PM joins and there is no system for sharing insights. The founder's intuition cannot transfer through osmosis.

Scale-up (50-100 people)

At this stage, multiple PMs need to run independent discovery streams. A dedicated researcher joins to set standards and support the team. Research ops emerge: participant recruitment, tool management, insight repositories.

What works: Weekly cadence per PM, shared insight repository, monthly cross-team synthesis. Each PM maintains their own weekly rhythm while contributing to a collective understanding of the customer base.

What breaks: When the researcher becomes a bottleneck. If all discovery must go through one person, the practice collapses back to project-based research.

Enterprise (500+ people)

Large organizations need a distributed model. Research ops manages participant panels, tools, and compliance. Domain teams own their discovery cadences. Cross-domain synthesis happens monthly to identify organization-wide patterns.

What works: Domain ownership with shared infrastructure. Each product team runs their own weekly cadence using shared tools and participant panels. Quarterly research summits bring teams together to compare findings and spot cross-cutting themes.

What breaks: When research becomes bureaucratic. If scheduling a customer call requires legal approval, participant recruitment, and a three-week lead time, continuous discovery dies under process weight.

At every stage, the principle remains the same: maintain weekly customer contact. The mechanism scales. The habit does not change. Connecting your discovery practice to a strategic product framework ensures that what you learn each week feeds into larger organizational decisions.

When Continuous Discovery Fails

In my coaching experience, the most dangerous failure mode is not teams that skip discovery. It is teams that believe they are doing discovery when they are not. I call this "research theater."

I coached a team that proudly reported running continuous discovery for six months. They had weekly customer calls on the calendar. They had a Dovetail repository with tagged insights. Everything looked right on paper. Then I asked one question: "Show me the last five product decisions that changed because of something you learned in discovery." Silence. They could not name a single decision that research had influenced. The calls were happening. The insights were being captured. But nothing was changing. The team had built an elaborate performance of discovery without the substance.

"Average human has almost 600 biases. The biggest one is confirmation bias." - Product Bakery Podcast

Three anti-patterns cause most continuous discovery failures:

1. Research theater. The team goes through the motions. Calls happen, notes get taken, but insights never reach decision-making conversations. The fix: tie every sprint planning session to at least one discovery insight from the previous week. If you cannot connect your current work to recent evidence, your discovery practice is theater.

2. Researcher bottleneck. One person (the UX researcher or a single PM) owns all discovery. When they are sick, on vacation, or overloaded, discovery stops. The fix: distribute the practice. Product trios (PM, designer, engineer) should all participate in customer conversations. The researcher sets standards and coaches the team rather than doing all the work. When teams are practicing customer development practices as a shared responsibility, the bottleneck disappears.

3. Insight graveyard. The team learns constantly but acts rarely. The insight repository grows, weekly summaries get posted, but the backlog does not reflect what the team is learning. The fix: create a direct pipeline from discovery to backlog. Every Friday synthesis should produce at least one backlog item (a new story, a reprioritization, or a killed feature).

Getting Started This Week

You do not need permission, budget, or a formal process to start continuous discovery. You need a calendar block and a phone.

This week: Block 90 minutes on your calendar for two customer conversations. Reach out to three recent users and ask: "Can I spend 30 minutes understanding how you use our product?" Two of them will say yes. After each conversation, write down one thing that surprised you. Share it with your team.

This month: Build the full habit loop. Establish your weekly cadence (adapt the model above to your schedule). Create a simple shared document for weekly insights. Start rotating methods. By week four, your team should expect your Friday insight share.

This quarter: Institutionalize the practice. Set up a participant recruitment pipeline so you never run out of people to talk to. Build a searchable insight repository so past learnings compound. Train your product trio on interview and testing techniques so discovery does not depend on one person. Evaluate which tools that support continuous discovery fit your team's workflow.

The compound effect of weekly discovery is powerful. After four weeks, you have 20+ customer touchpoints informing your decisions. After a quarter, you have 60+. After six months, your team has built an institutional understanding of your customers that no competitor running quarterly research can match.

Track your progress with a simple scorecard. Each week, record: how many customer touchpoints you completed, which methods you used, what you learned, and what changed in the product because of it. After a month, review the scorecard. You will see patterns in which methods produce the most actionable insights for your context. Double down on those methods and reduce time spent on less productive activities. The scorecard also serves as evidence when you need to justify the practice to leadership. Showing that 15 out of 20 sprint stories in the last quarter originated from discovery insights is a more compelling argument than any theoretical framework.

Need help building a continuous discovery practice in your team? Learn about my product coaching services to get hands-on support with frameworks, cadence design, and team coaching.